Lectures for Institute of Applied Mathematics, Middle East Technical University

Problem Statements in Time Series Forecasting

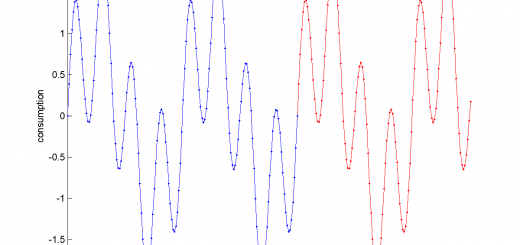

The talk includes statements of the machine learning problems in risk management, as well as consumption and financial time series forecasting. Two problems of time series forecasting will be discussed. The first one is the autoregressive forecasting for the periodic (i.e. goods, electricity consumption) and non-periodic (stock prices) time series. The second problem is the time series classification problem: one has to forecast a class label the time series belongs to. This problem is tightly connected with the financial bubbles detection.

Model Selection Algorithms

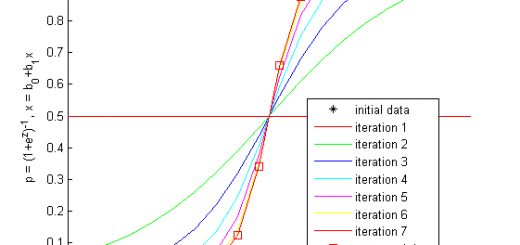

To select the optimal model the set of competitive features are inductively-generated; thus the number of the investigated time series is large. We discuss the feature selection algorithms that consequently filter the noise and multicorrelated time series to select the optimal combination. The talk is devoted to various algorithms of model selection. It will show how to select a simple, precise and stable model bring good practical forecasts.

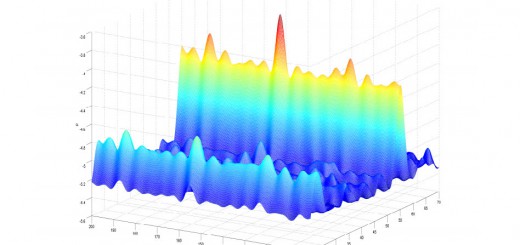

Model complexity and multimodelling

To select the model of optimal statistical complexity one must either split samples of the data set into test and training subsets and run the cross-validation procedures or estimate the model complexity directly using the Bayesian inference. The second method requires statistical hypothesis on the target (forecasted) variable and, as the consequence, on the model parameters.