A volatility smile modeling is one of the actual problems in finance mathematics. Here is an example how to make a regression model of the volatility smile using historical data of an option.

Contents

Load the historical data

rawdata = dlmread('option_AP04.csv'); % read history file time = rawdata( :,1 ); % extract time values maturity = -1/365*time; % convert time options= rawdata( :,2:7 ); % extract price of the option for each strike price = rawdata( :,8 ); % extract price of the stock clear('rawdata', 'time'); % do not need anymore strike = [13.50 13.00 12.50 12.00 11.50 11.00];

Calculate the impied volatility using the Black-Sholes’ model

for i=1:length(strike) % doc blsimpv for more information impvol(:,i) = blsimpv(price, strike(i), 0.075, maturity, options(:,i), 1.5, 0, [], true); end

Plot the source data

figure; subplot(1,2,1); % Tri = delaunay(x(:,1),x(:,2)); % trimesh(Tri,x(:,1),x(:,2),y,'EdgeColor','black'); % camlight left; lighting phong; alpha(.8); [X,Y] = meshgrid(maturity, strike); mesh(X,Y,impvol'); scalevec = [min(maturity) max(maturity) min(strike) max(strike) min(impvol(:)) max(impvol(:))]; axis(scalevec); xlabel('maturity'); ylabel('strike'); zlabel('implied volatility');

Make the regression Maturity and Strike to ImpVol

% we have: maturity [T,1] T = 64 % strike [1,S] S = 6 % impvol [T,S] % let x be independent variable and y be dependeny variable [X,Y] = meshgrid(maturity,strike); x = [X(:),Y(:)]; % vectorize and concatenate clear('X', 'Y'); impvolT = impvol; y = impvolT(:); % now we get x and y

Check it with a simple example

% mat = [1; 2; 3; 4] % str = [22 33] % imv= [122 133; % 222 233; % 322 333; % 422 433] % ivT = iv'; % % [X,Y] = meshgrid(mat,str) % x = [X(:), Y(:)] % y = imvT(:)

Check the sample set for NaNs

idx = [ find(isnan(y)); ... find(isnan(sum(x,2)))]; % note that val+NaN = NaN y(idx) = []; x(idx,:) = [];

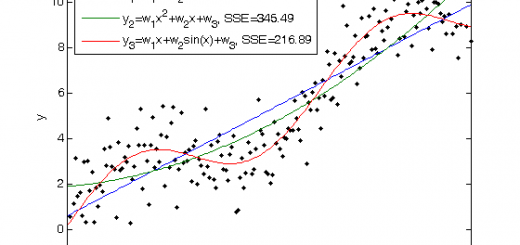

Assign the model

the model is % impvol = w(1) * maturity^2 + w(2) * maturity + w(3) * strike + w(4); Making of more complex and more adequate

model is outside of this example. You can try MVR Composer to make this kind of models inductively.

% weak code % A = []; % for s = strike % S = [maturity.^2, maturity, repmat([s^2 s 1], [length(maturity) 1])]; % A = [A; S]; % end % better code f = inline('[x(:,1).^2, x(:,1), x(:,2) , x(:,2).^0 ]','x'); A = f(x); w = inv(A'*A)*A'*y; y1 = A*w;

Plot the result

subplot(1,2,2); Tri = delaunay(x(:,1),x(:,2)); trimesh(Tri,x(:,1),x(:,2),y1,'EdgeColor','black'); camlight left; lighting phong; alpha(.8); xlabel('maturity'); ylabel('strike'); zlabel('implied volatility'); axis(scalevec);